💰 Your First Step in Brokerage Budgeting

This program is meticulously structured to guide owners and accounting managers through the fundamentals of Real Estate Brokerage Budgeting. With clear explanations of the budgeting workflow across all key financial areas (revenue forecasting, expense planning, and cash flow analysis), you’ll quickly build confidence in understanding how and from where to start monitoring the firm's performance. Supportive resources and real-life examples make learning the core principles of variance analysis and key performance indicators (KPIs) engaging and accessible for everyone.

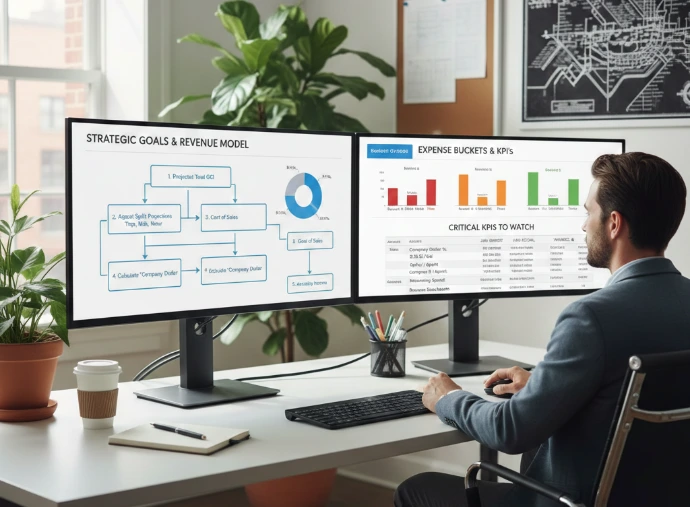

📊 Learn the Performance Monitoring Workflow

Practice essential management skills such as mastering the workflow for Revenue Forecasting, Expense Budgeting, and Cash Flow Planning. Our hands-on approach ensures you gain practical experience, making complex concepts like proper budget construction and the unique functions of performance monitoring easy to grasp and apply to your own responsibilities as an Accounting Manager or Brokerage Owner.

📈 Personalized Monitoring Tools

Track your progress and revisit core budgeting concepts at your own pace. Our platform allows you to bookmark lessons, take notes on KPI definitions and budget model examples, and access quizzes directly within the program, helping you stay organized and motivated as you master the foundations of real estate brokerage finance and develop the skills needed to continuously monitor company performance.

🌟 Key Program Features

Our learning features are designed for simplicity and effectiveness. Enjoy interactive tutorials, visual aids , and easy-to-follow guides that break down complex budgeting strategies and performance monitoring techniques into manageable sections. Whether you're new to creating financial forecasts or looking to refresh your knowledge, our program adapts to your needs for a smooth learning experience, preparing you to effectively monitor company performance as an Owner or Accounting Manager.

💼 Step-by-Step Modules

Advance through structured modules that cover everything from establishing key performance indicators (KPIs) to advanced variance analysis and cash flow forecasting. Each section builds on the previous one, allowing you to develop a comprehensive understanding of the budget cycle and the process for monitoring financial health at your own pace.

📊 Practical Case Studies

Explore real-world brokerage budgeting scenarios and case studies that illustrate key concepts in revenue projection, commission expense control, and budget-to-actual reporting. These scenarios help you connect budgeting theory to strategic operational practice, making it easier to apply what you've learned to creating accurate forecasts and making data-driven decisions to monitor and improve the firm's financial standing.